| Table of Contents |

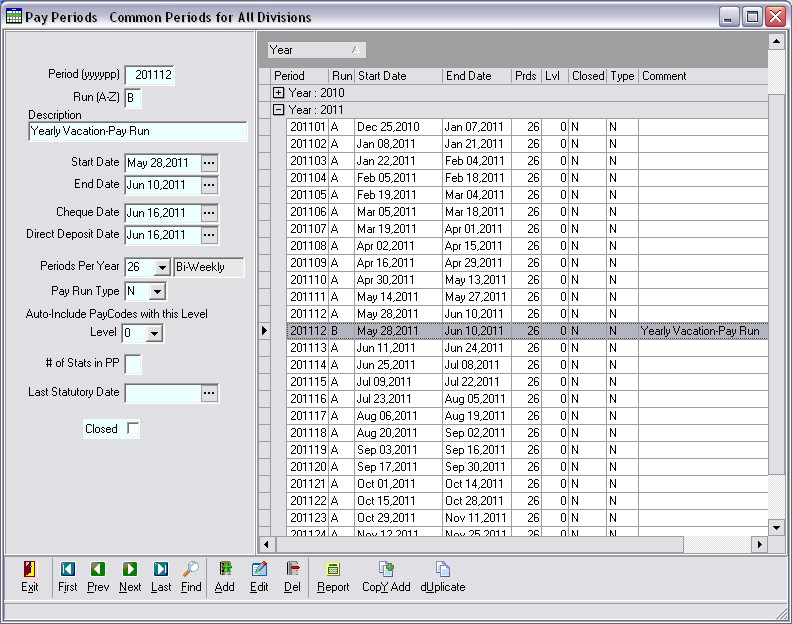

Period: as YYYYPP where the first four digits represent the payroll year and the last two digits represent the period within the year (ie; 200101)

Run Code: Enables you to have more than one pay run within a pay period (ie; B-Runs could be defined for Annual Vacation Pay, Bonus Runs).

Start/End Dates: Enter the start and end dates of the time transactions that the period covers.

Cheque/Direct Deposit Dates: Enter the payment date(s) to be recorded in the pay records when they are created. Note: If auto-adding periods then this date may need to be changed ie; if Statutory holiday falls on a pay date and must be moved ahead, or if a bonus or vacation run must be paid on a certain date.

Closed: if checked, the closed field tells the other programs in the system that no changes can be made to the data. When the Batch Pay program is run in the live mode the user is asked at the end of the run wether to close the pay period or not. If Yes is selected then the closed field is updated to the checked state. In certain situations the payroll administrator (or a user with a high enough security level (9)) can re-open the pay period (by unchecking the field) in order to do further data manipulation. For instance: The period has just been closed and it is discovered that someone was not paid. The payroll administrator unchecks this field, adds some time transactions or journal entries then uses the manual pay program to create the pay record and finally returns to this program and closes it. Note: the foremen have a separate field that indicates wether a period is closed or not (see: Crew Sheet Time Entry).

Posted: The Posted field is not currently used but is displayed in preparation for upcoming changes.

Periods/Year: Use the drop-down to select the periods per year to be used for the tax calculation. ie; 26= bi-weekly, 24= semi-monthly etc. Note: If the Pay Run is a Vacation Pay run and you will be using the Vacation Pay Tax calculation then this field should be set to 52 weeks.

Pay Run Type: Select from N(ormal), B(onus), to V(acation) for Annual Vacation Pay Run. This field is informative only.

Include Pay Codes of Level: Set to 0,1, or 2. This field works in conjunction with the 'Frequency Level' field in the Pay Codes Definitions in that it indicates which benefit and/or deduction (ben/deds) pay codes are to be included in a pay run. 'O' indicates no level (or every run). When a pay record is being created (batch or manual) the employee's benefit/deduction lists are scanned to find any ben/deds whose pay code's frequency level matches the this fields level. Note: employee ben/ded records whose pay codes have their frequency level set to '0' will be always be included if they are marked as active.

For example; If you want taxable benefits to be included in the first pay period of a month then you can set the pay period's Level field to '1' and set the Frequency field in the taxable benefit pay codes to '1'. It makes no difference if you use '1' or '2' as long as the pay codes's frequency field matches what you set in the period's record. If you want union dues (or any other non-regular deduction) to be deducted in the second pay in a month you would then set the pay period record's Level field to '2' and set the deduction pay codes Frequency field to '2' as well. If there is a third payroll within a month where no ben/deds should be included then the pay code level should be set to '0'.

| Table of Contents | Top |