BATCH CHEQUE RUN

DESCRIPTION

Create pay records as a batch for a pay period. Options available to select tax calculation, calculate EI/CPP or not, select employee (for a single pay record), force all records to cheques, include employee benefits/deductions and include/exclude missed deduction processing. Allows the user to create a pay run in a trial balance run before committing changes to the database.

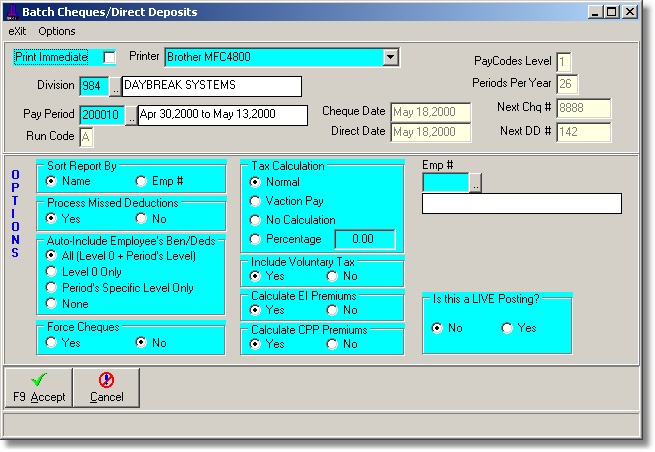

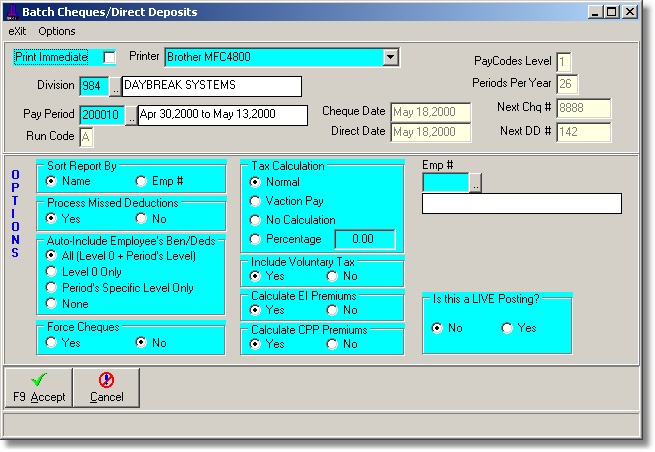

OPENING SCREEN

PROCEDURES

Go to Main Menu > Payroll Tab > Create Batch Pay Cheques/Direct

Deposits and complete the following:

Division: Select specific division. If you are running a combined payroll of more than one division, you can leave this field blank which will select All divisions.

Pay Period: Select the pay period to process. For users running the Annual Vacation Pay, ensure the pay period selected is for the vacation run, typically set up as a 'B' run in the pay periods maintenance.

Cheque/Deposit Dates: The dates are pulled directly from the current Pay Periods master record. Verify the dates shown. If not satisfactory, go to the Periods maintenance module to change.

Include Pay Codes of Level: The pay code level is pulled directly from the Pay Periods master record. For the Annual Vacation Pay Run, the pay codes of level should be '0'.

Pay Period Per Year: The Periods Per Year is pulled directly from the Pay Periods master record.

Sort Report By: Select by employee name or employee number.

Process Missed Deductions: If selected, missed deductions from previous pay periods will be processed in the current pay. Typically for the Annual Vacation Pay run, this option is not selected. For employees requiring specific deductions to be deducted at vacation pay time (i.e., outstanding loans, computer loans, purchases, etc.) the regular journal entry program should be used.

Force Cheques: Choose this option if you would like to produce cheques for all employees, regardless of what has been previously set up in the Employee Pay Method Maintenance screen.

Tax Calculation: You have the option to select the following methods of taxation: Normal, Vacation Pay, No Auto Calculation and Percentage.

- Normal: Used for regular pay cheque runs, based on a 26 bi-weekly pay period. The Normal calculation is sometimes used for the Annual Vacation Pay Run if the division has decided to use a normal tax calculation.

- Vacation Pay: Used for the Annual Vacation Pay Run, based on a annualized weekly calculation.

- No Auto Calculation: Used when no tax calculation is wanted.

- Percentage: Used when you want to give everyone a flat percentage rate. Sometimes used for the Annual Vacation Pay Run if the division has decided to use one rate for all.

Include Voluntary Tax: Select if you want to include the voluntary tax as set up in the Employee Pay Maintenance screen.

Calculate EI Premiums: Usually always set to 'Yes'.

Calculate CPP Premiums: Usually always set to 'Yes'.

Is This A Live Posting: Always choose 'No' until you have verified a Trial Mode run. Once satisfied with your totals, select 'Yes' for a live posting. The system will then update all the YTD records for each employee.

Note: If there are any errors detected (i.e.; negative net pay) the program will not post any transactions even if you have selected the Live Posting. A description of the error(s) will be printed at the end of the report.

Press F9 or click Accept to proceed after ensuring that all options are set correctly.

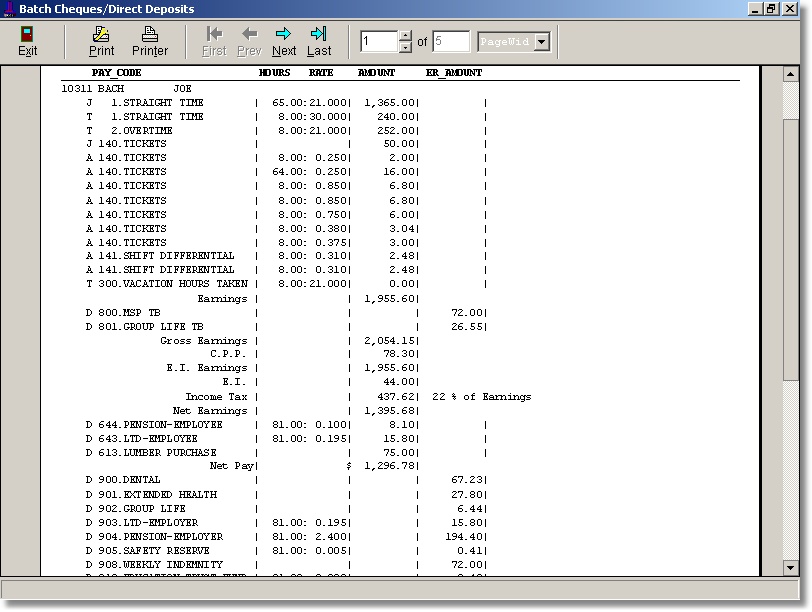

Pay Record Details

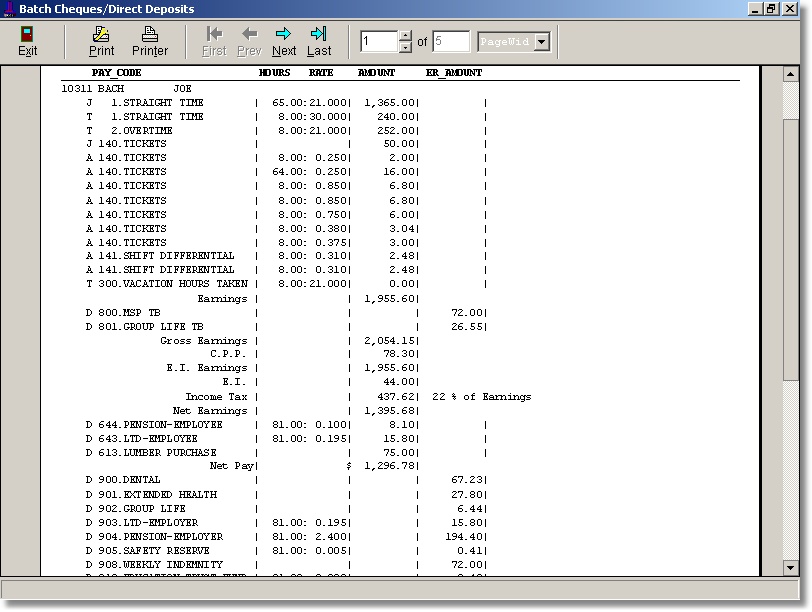

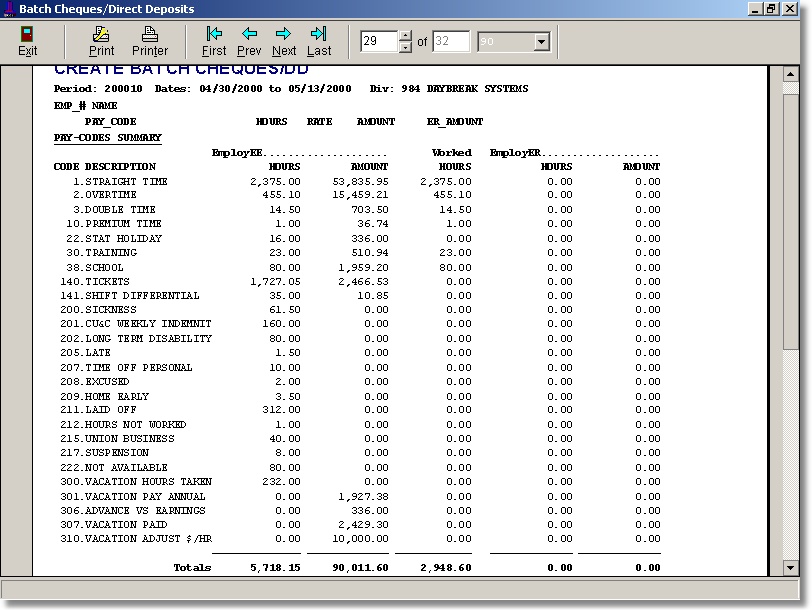

The following screen shows a sample of the details generated for each employee. These can be reviewed to ensure that all transactions for the employee have been processed.

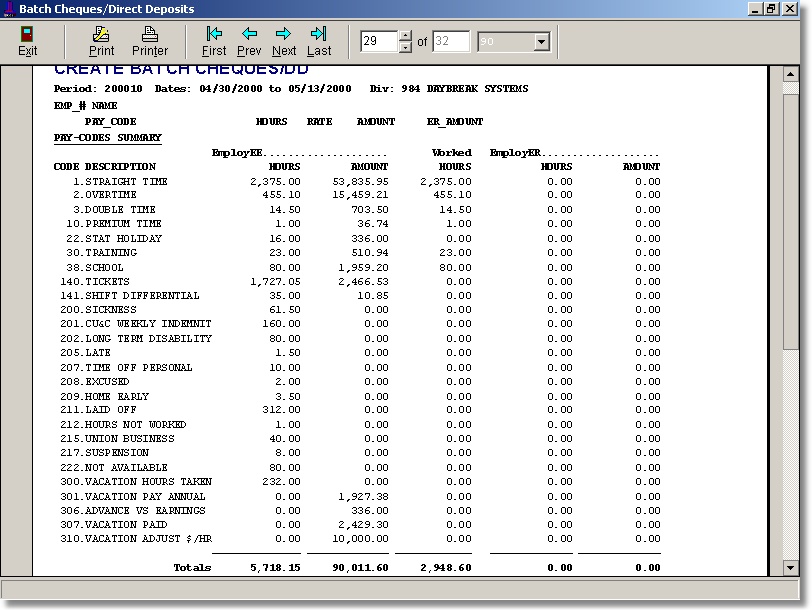

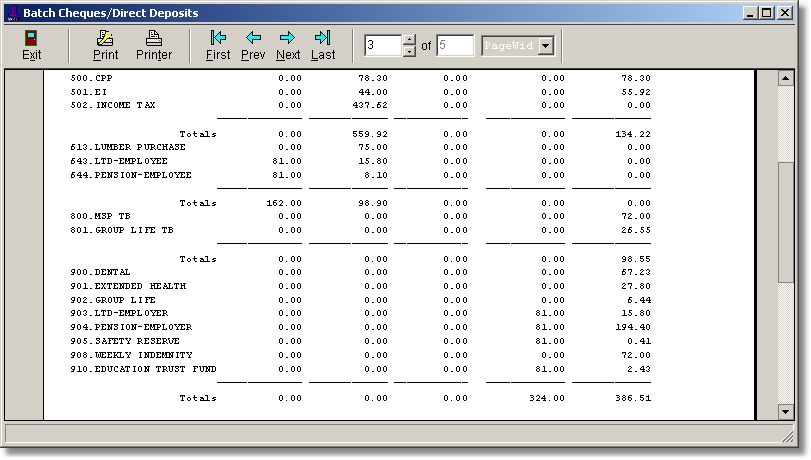

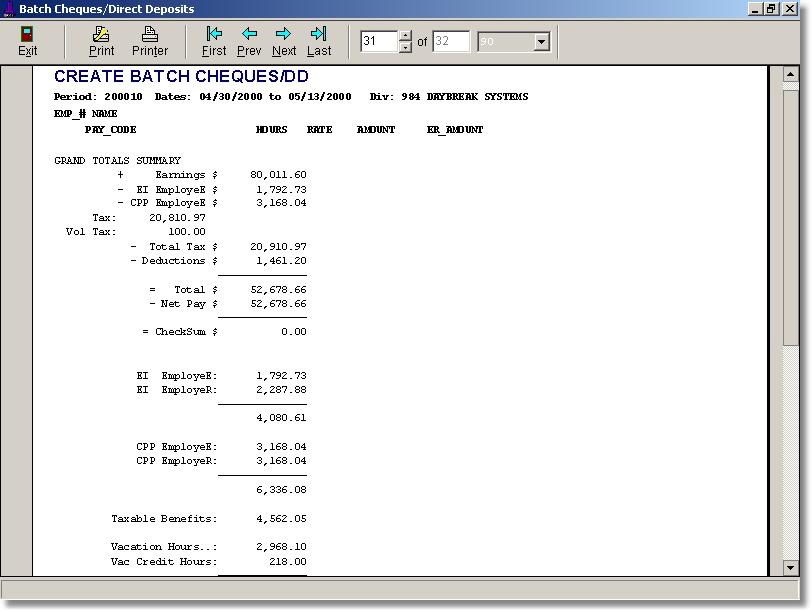

A Summary by Pay Codes is then listed. The Earnings totals should match the totals obtained from the Hours Inquiry Report in order to ensure that all (unposted) time transactions have been processed.

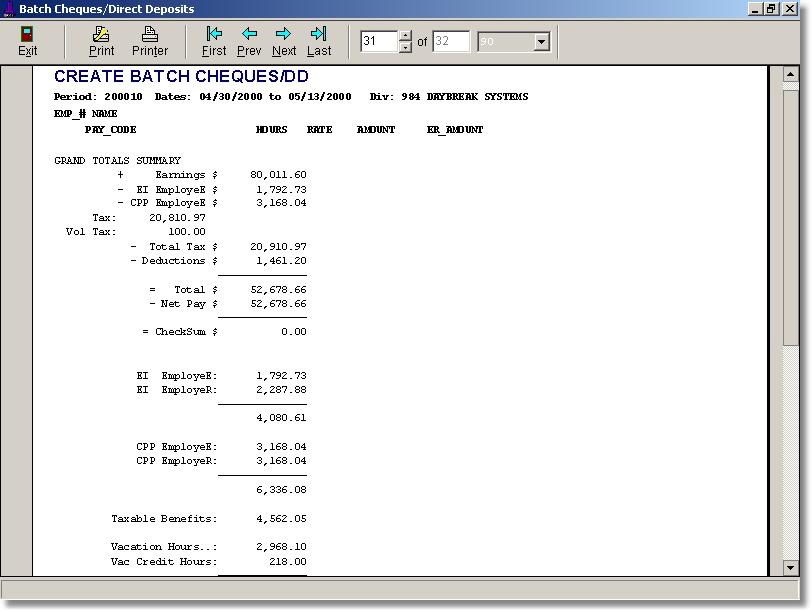

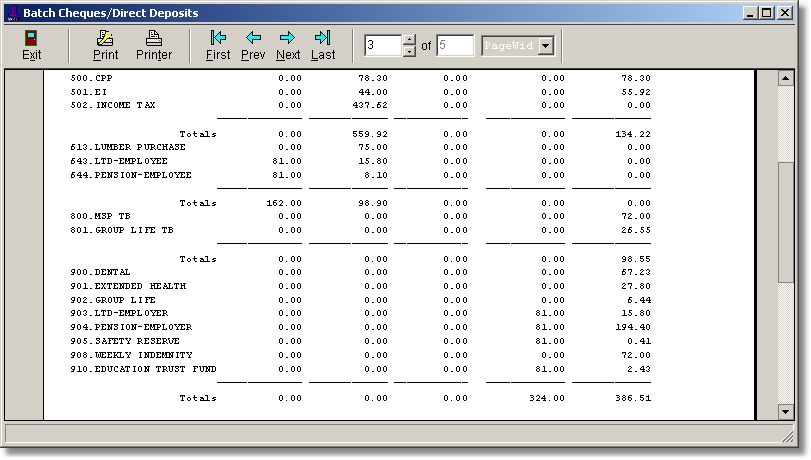

Finally a Grand Totals Summary is listed.