| Table of Contents |

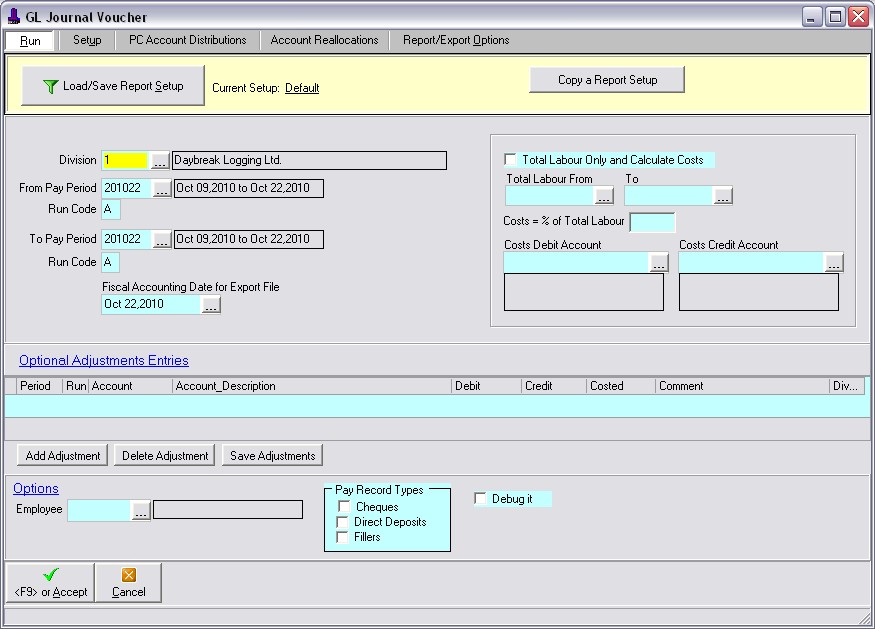

Pay Period: a range must be entered.

Division: Optional. Leave blank for all or enter a specific division or tag the division list -F2.

Other Cost Accounts: Optional. This area allows you to enter any additional costs that are not tracked in the payroll system.

Employee: Optional. Enter an employee # to show only the information for the employee's pay record(s). Sometimes useful for debugging discrepancies and displaying the accounts entered via the time-entry programs.

Find Unbalanced Entries: Optional. If this field is checked the program will print details for pay records that do not balance. For instance: You've used a new Deduction paycode and haven't defined an account distribution record for it.

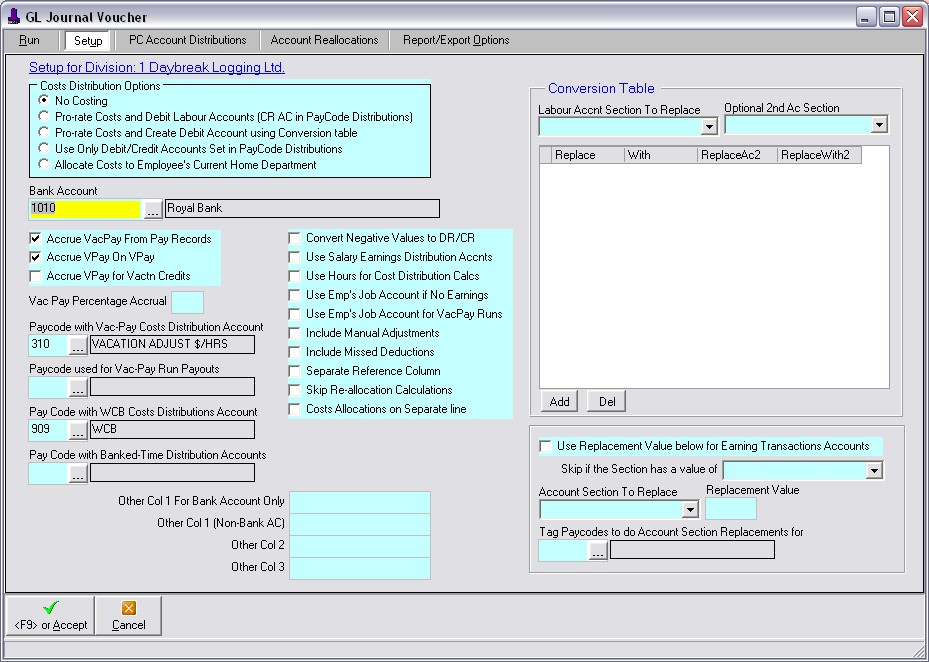

Cost Distribution Options: Select the type of Costs Distribution to use. See below for details.

Bank Account: Enter the account number to used for the bank (net pay credit).

Accrue VacPay from Pay Records: checking this option will total the vacation pay from each employee's pay record.

Accrue VPay On VPay: Checking this option will calculate and total the vacation pay on vacation pay amount from each employee's pay record.

Accrue VPay for Vactn Credits: Checking this option will calculate the vacation pay for any vacation pay credit earnings from each employee's pay record.

Vacation Accrual Percentage: a percentage may be entered to calculate a vacation pay accrual amount as a percentage of the total earnings. You may want accrue an extra amount each pay run to cover vacation related costs such as catch-ups, vacation rate changes, hourly-option, WCB...

Vac-Pay Paycode with Distribution Account(s): If using any of the above 4 options then the program needs to know which account to post the amount(s) to. This is accomplished by adding an account distribution record to a paycode and then entering the paycode in this field. This can be any paycode but is typically a VacationPay related paycode.

Paycode with WCB Account Distributions: If you want to total the WCB premiums from the pay records then the program needs to know which account to post the amounts to. This is accomplished by adding an account distribution record to a paycode and then entering the paycode in this field. This can be any paycode but is typically the WCB paycode.

This method will total the employer costs and pro-rate the costs back to each labour account based on the percentage of each labour account's amount of the total labour amount. The following Pay Code Types must have their Distribution Accounts set up to calculate correctly:

| PayCode Type | Debit/Credit | Use Account from |

| 'E'arnings | DR | Transaction Records |

| 'S'tatutory Deduction | DR/CR | PC Account Distributions |

| 'D'eduction | DR/CR | PC Account Distributions |

| 'B'enefit | DR/CR | PC Account Distributions |

| 'T'axable Benefit | DR/CR | PC Account Distributions |

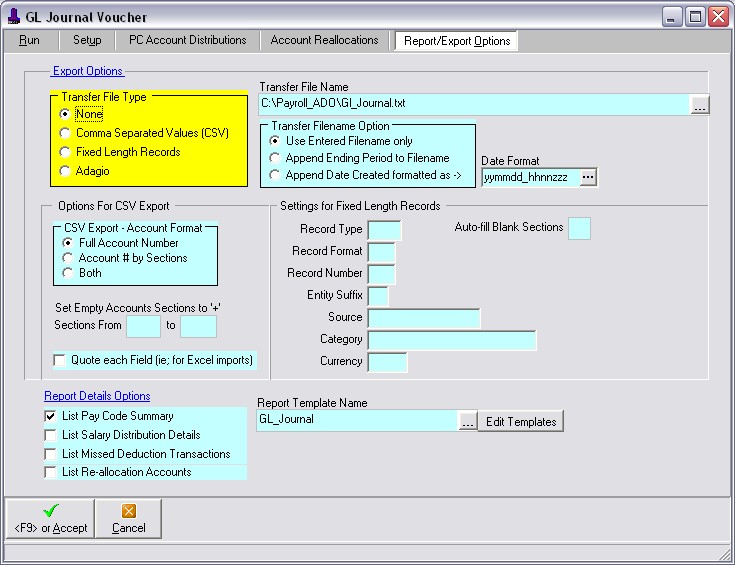

List Pay Code Summary/List All Details - additional options to list the information in more detail.

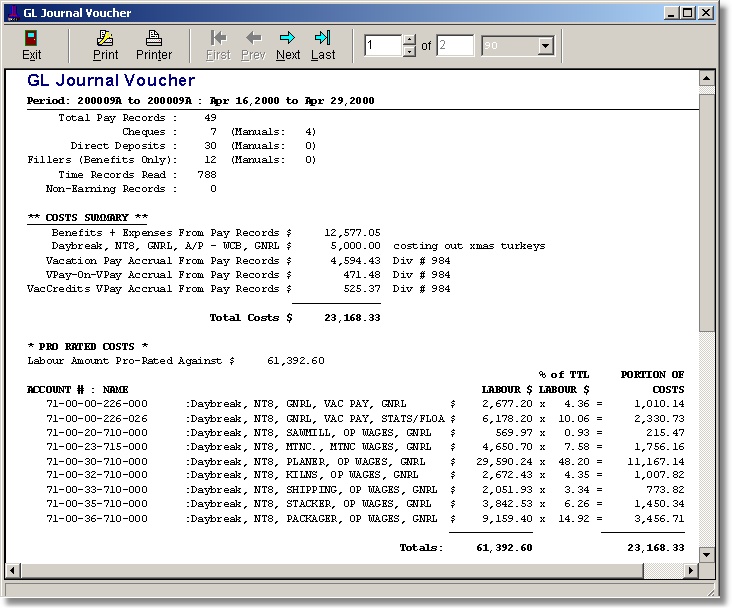

Once the set-up is completed the system will produce a GL Journal Voucher detailing a breakdown of the following:

A detailed list of Employer Costs and a grand total of the costs.

A total and a list of totals by account of the Earnings used for Cost Distribution calculations. These earnings are totalled from the time transaction records if their pay code's 'Not Pro-rated' is not checked. Earnings that should not be included in this grand total would typically be Vacation Pay Advances/Payouts as the amounts would have been costed-out in a prior period when it was generated and is not to be considered a cost when being paid-out. The Pay Code used for the Vacation Pay Advances should be flagged as 'Not Pro-rated' to not be included in this total.

The Account, Name and Earnings amount totaled for each labour account.

The percentage of total labour, with the cost amount calculated for each labour account.

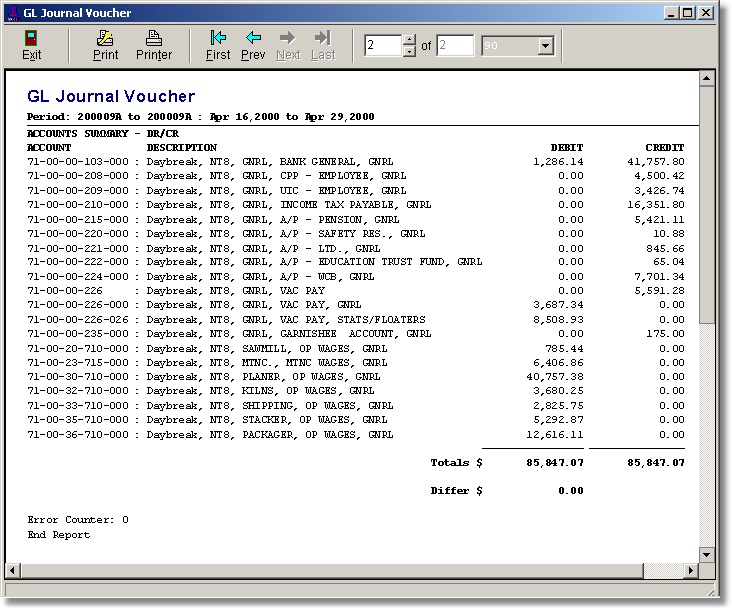

An Accounts summary showing each account number and description. The costs associated to each account will be listed under the Debit and/or Credit columns. A final totals summary will be shown at the bottom of the details.

This method is to be used if the pro-rated option is not elected. The pay code accounts must be set up to include an account attached to the Debit side. The following benefit/costs must be set up to calculate correctly:

- All 'D'eduction Employee pay codes are to be set up as a Credit.

- All 'S'tatutory Deductions pay codes are to be set up as a Credit.

- All 'B'enefit pay codes are to be set up with both a Credit and Debit Distribution Account.

- All 'T'axable Benefits pay codes are to be set up with both a Credit and Debit Distribution Account.

Once all the set up is complete, the system will produce a GL Journal Voucher detailing a breakdown of the following:

- A grand total of all the benefit costs/employer expenses.

- An accounts summary showing each account number and description. The costs associated to each account will be listed under the Debit and/or Credit columns. A final totals summary will be included at the bottom of the detail.

This sample report shows cost distributions using the first Pro-Rating method.

| Table of Contents | Top |