| Table of Contents |

This module allows the user to maintain the Benefit and Deduction records. Note: These are referred to as Ben/Deds throughout this manual.

Ben/Ded records allow for multiple rates per pay code. Every Ben/Ded code must be tied to a master Pay code.

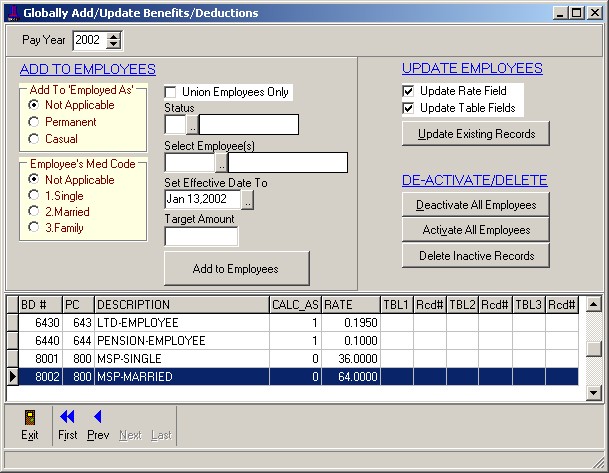

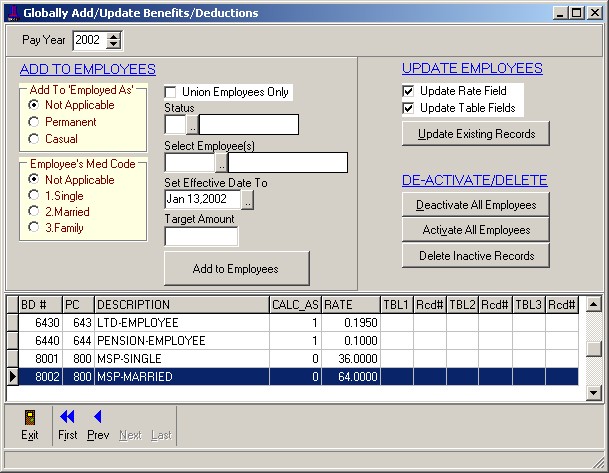

Each employee will have his/her own list of ben/ded records per payroll year. Ben/deds can be added to employees either via the employe maintenance module or via the 'Update Employee' option described below.

The rates entered for each ben/ded are only used as a default for adding or updating employee records. When a ben/ded record is added to an employee's ben/ded list it is a copy of the original and the rates can then be modified if neccesary for each employee. When a pay record is generated the rates in the employees' records are used.

OPENING SCREEN

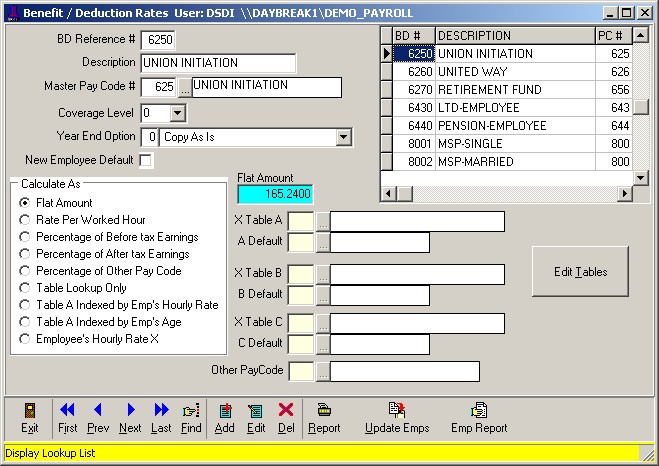

The following must be entered when adding or updating a ben/ded record:

BD Reference: Unique number to identify Ben/Ded record. You may want to use the convention of using the ben/deds master pay code and adding 0-9 at the end of it.

Description: Descriptive title of the Ben/Ded.

Master Pay Code Number: Enter the pay code that this ben/ded is related to.

Coverage Level: Used for adding records to employee's where this coverage level matches the employee's medical level. (primarily for medical/insurance-type codes). Options include Single, Married, Family and Not Applicable.

Year End Options: This field should be completed dependent upon the action required for the ben/ded codes at year-end. Options include Leave as is, Zero YTD totals, Zero Target and YTD totals, and Delete if Target total is reached.

New Employee Default: Check if you want the ben/ded to be automatically added to the employee's Ben/Ded list when entering a new employee in Employee Maintenance. You need only to verify the employee ben/ded table as the system will automatically set up all options for you.

Ben/Ded Calculation types:

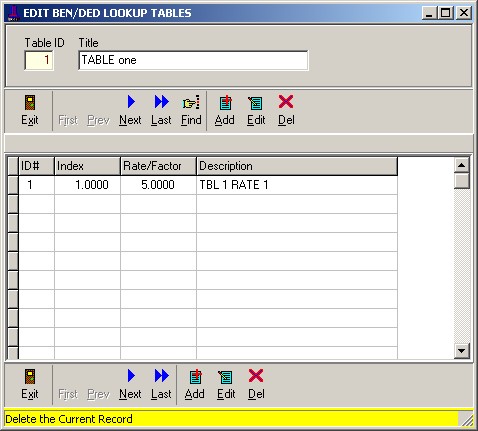

TABLE SET-UPS

For the benefit/deduction codes that require more than one basic calculation, the adjoining 'Table' fields may be set up. To achieve this, click the 'Edit Tables' button on the right side of the window. This area will allow you to set up variables needed to produce the correct calculation of your benefit/deduction code. The screen is divided into two sections. The top section lists the name and title of the benefit/deduction variable, and the lower section lists the detail. You may set up numerous calculation variables, depending on what is required.

When a ben/ded amount/rate/percentage changes the appropriate field must be updated in the employees' records.

To accomplish this:

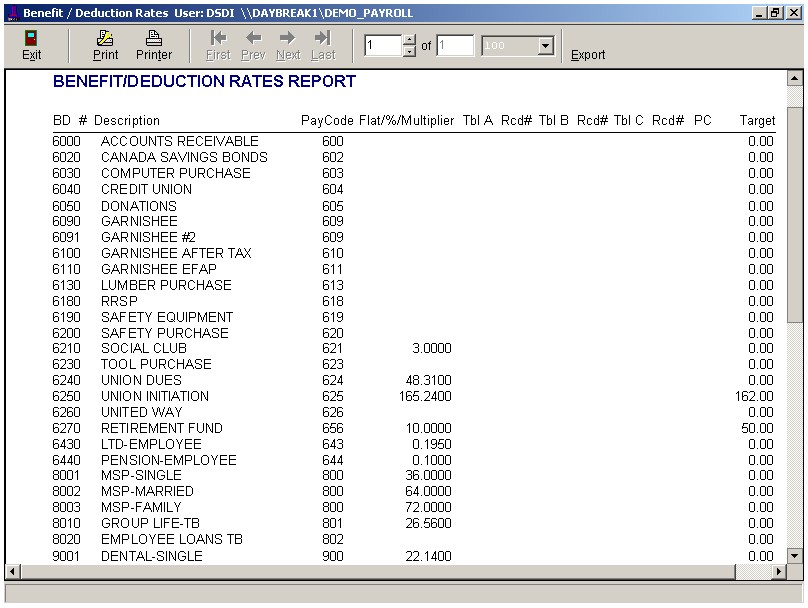

Click the report option on the menu bar to generate a report of the ben/ded records.

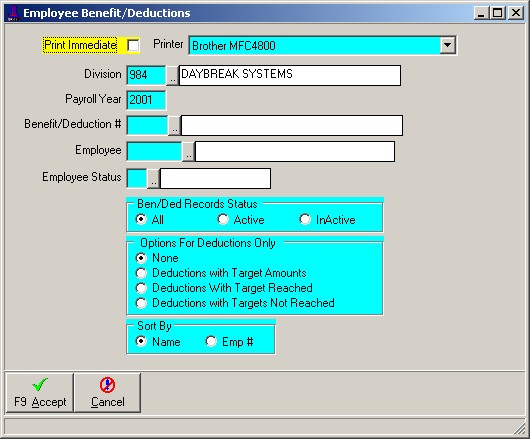

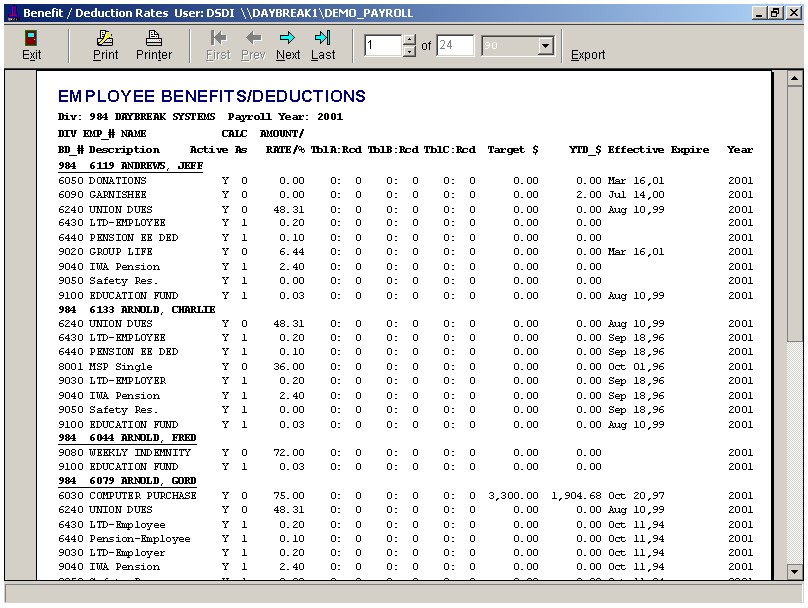

This report lists the employees' ben/ded records. For a report listing benefit/deductions generated from each pay run, please see Benefit/Deductions Report in the Payroll Section.

The user may choose a listing by ben/ded code(s) (all, 1 only or tagged list), by specific employee(s), by payroll year(s) and/or by the ben/ded records status (All, Active, Inactive). This report is also available from the main payroll's employee menu.

| Table of Contents | Top |